Starting a business is exciting—the ideas, the drive, the possibility. But it’s also incredibly stressful—the finances, the first step, the never-ending list of things to do.

We can’t help with that never-ending list, but we can help break down a big choice you’ll have to make soon: LLC vs. C corp. Here is everything you need to know in order to choose the type of entity for your new company.

In this guide, we’ll answer:

- What is an LLC?

- What is a C corp?

- Why start an LLC?

- Why start a C corp?

But first things first, let’s start by answering whether or now you really need to form an LLC or a C corp to get started.

Can I start a business without an LLC or C corporation?

Yes, you can! However, creating an LLC or a corporation can not only provide liability benefits to protect yourself and your assets but also open up tax benefits. Creating a company gives you the ability to open up a US business bank account, too, which allows you to create clear separation between personal expenses and business expenses.

The key is finding which option will work best for your business. We can’t and aren’t giving any legal advice, but we can help with information. Let’s break down LLC vs C corp differences now.

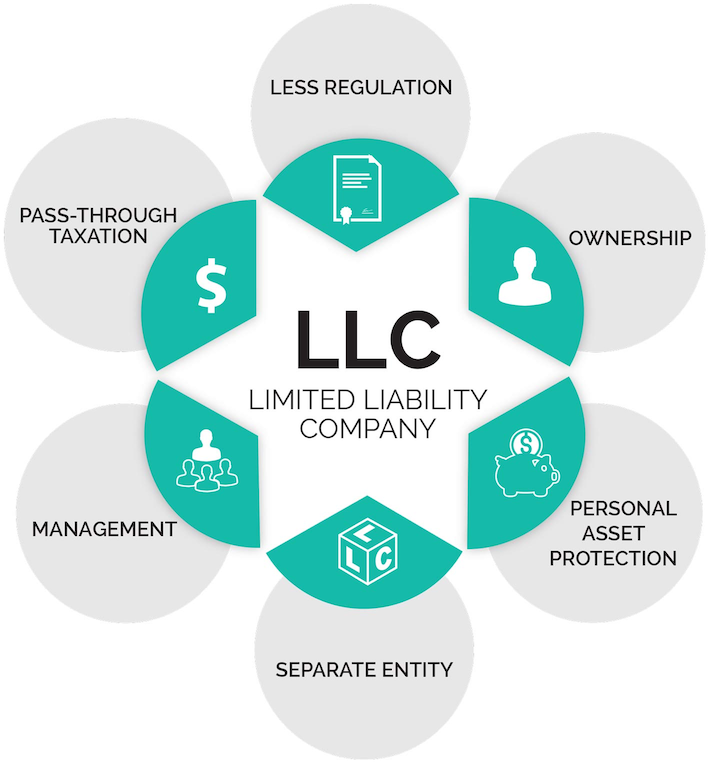

What is an LLC?

An LLC is a limited liability company.

As the name implies, it gives you "liability protection" because it is a separate entity from you. Therefore, any liabilities your business incur would be associated with and fully belong to the business instead of you. You can read more about LLCs in more detail at Investopedia.

Although most of the time small businesses can and choose to be LLCs, some large businesses have chosen this legal structure as well. (For example, Anheuser-Busch is an LLC!)

What is a C corporation?

A C corporation is a type of company owned by shareholders. These shareholders then purchase shares of stock which reflect ownership of the company. C corporations have a rigid ownership structure, which offers pros (ease of investment from investors) and cons (less flexibility, more ongoing paperwork/governance) that we’ll talk more about soon. You can read more about C corps in great detail at Investopedia.

As an example, C corps may have many shareholders or owners, but the ability to offer stock of the company allows C corps to then raise capital, which can help them grow and expand in the future! As an example, Facebook is a Delaware Corporation, and large companies that are looking to raise capital from investors tend to be C corps.

LLC vs C corp

Now that you know what an LLC is and what a C corporation is, let’s talk about how these two entities compare so that you can make the best decision for your company.

Formation

To form an LLC you file your articles of organization with the state. To do this you can visit the states website and submit the form directly there. As an example, here is the website for the Wyoming Secretary of State. You can click the “Business E-Filing” button and form or register a new business directly through the state online which will involve filing the articles of organization.

After this you draft and sign an operating agreement that outlines the business, as well as ownership percentages, rights, and responsibilities. There are common templates for operating agreements, which you can use and find online and this agreement is a document internal to your LLC.

To start a C corporation you file your articles of incorporation with the state. After this is filed, you then have to complete the "post-incorporation" setup, which includes but is not limited to: creating corporate bylaws, holding shareholder meetings, issuing shares of stock, electing a board of directors, and sending in an 83(b) election to the IRS. As an example, to create a Delaware C corporation, the full steps are outlined here on the Delaware Division of Corporations website.

To learn more about the post incorporation set up, which includes issuing founder stock, filing 83(b) elections, electing a board or directors and more here is a great resource from the law firm Cooley.

Advantage: LLC. It’s easier to form, and there’s no extensive post-incorporation setup required. It's also popular with landlords.

Taxes

C corporations pay a corporate income tax.

LLC owners can choose to have their business taxed as a pass-through entity. This means that they’ll pay tax on business income on personal tax return, or they can elect to have their business taxed as C corporation.

C corporations face "double taxation." What this means is a business is taxed at the corporate level once, and then if the individual receives a dividend or earnings from the business, they then have to pay tax again on their personal tax returns.

Advantage: Tie. This depends on the individual’s personal income tax rate and corporate tax rate in a given country, as well as the ease of filing taxes for you as a business.

Ownership

Corporations are more complicated but allow you to raise money from investors more easily.

LLCs have a more flexible ownership structure where you have one member, two members, or multiple members. You can even have a "manager-managed" LLC, where an external appointed individual runs your business.

If you want to brush up on the ownership structures of both LLCs and C corps and understand how they work in great detail, here is a great guide on LLCs and C corps.

Advantage: Tie. This all depends on your goals as a business

Meetings

C corporations are required to hold corporate and shareholder meetings. LLCs do not have these obligations.

Advantage: LLC. You have less oversight and no required meetings.

Fundraising

Venture capitalists can easily invest in a C corporation. As Investopedia explains, “the ability to offer shares of stock allows corporations to raise large amounts of capital, and they exchange this stock with investors in return for capital.”

This is much more difficult for an LLC. Due to the varying structure, it can take much more diligence and research from investors to make an investment. Because LLCs don’t have shares of stock to issue, and instead have ownership percentages aligned with membership interests, as Nolo explains, you can sell membership interested in the LLC to investors to raise money.

Advantage: C corporation. It’s easier to raise capital.

Liability

In an LLC and C corp, members/owners are not personally responsible for liabilities or business debts.

Advantage: Tie. Both offer liability protection.

Paperwork and ongoing governance

C corporations require more ongoing governance and paperwork to maintain corporate status and stay compliant. This includes the meetings mentioned above.

Advantage: LLC—kind of. An LLC has less ongoing work governance and paperwork, which can be expensive and time-consuming.

But, there’s a twist: C corp also has the advantage of keeping all this required documentation up-to-date. This will help when it comes time to issue shares and make other big company changes.

Why start an LLC?

So why would you want to create an LLC? Here are a few reasons.

- Lower annual fees: Generally speaking, LLCs pay less in annual fees.

- Greater tax flexibility: You can choose how you are taxed (i.e., avoid double taxation and be taxed as a "pass-through entity"), or you can elect to be taxed as C corporation if you'd like.

- Easier upkeep with less ongoing governance: It's easier to keep your LLC running / there is less ongoing paperwork and administrative governance work which can be expensive and time-consuming.

Why start a C corporation?

Here are a few reasons:

- Easier to raise investor capital: Not only is it easier, but in some cases, a C corporation is actually required to raise venture capital (i.e., most US investors).

- The ability to offer stock options: Offering stock options is a way to create incentives between employees and the company, beyond revenue shares, and it can also be a great way to attract and hire top talent.

TL;DR: LLC vs C corp

At the end of the day, it's your business and, therefore, your choice! Take this information above into consideration and think about your business as it is and as you’re hoping to grow in the near future.

We also recommend chatting with a licensed attorney or certified professional accountant to answer any and all questions you might have that go beyond the scope of this article to help you weigh LLC vs C corp for your business.

About the author

Arjun Mahadevan is the co-founder and CEO at StartPack.